• Growth in debt settlement was 6.2 pp compared to 2022;

• “Bank/Cards” sector was the most prioritized by consumers in the period

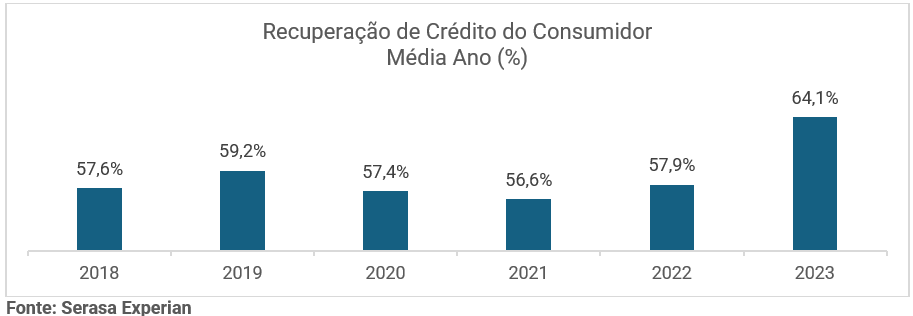

In 2023, of the total negative debts, defaulting consumers regularized or renegotiated 64.1% within 60 days of the end of the year, according to the Serasa Experian's Credit Recovery Indicator. This is the highest percentage ever recorded by the index since the beginning of historic Serie =. In relation to 2022 (57.9%), the difference was 6.2 percentage points. See below the movement in debt settlement of consumers with the name in red year by year:

“The decrease in interest rates and inflation contributed to greater settlement of outstanding debts by consumers, resulting in greater stability in default rates. The Federal Government's Desenrola program also encouraged Brazilian citizens to settle their financial debts”, says Serasa Experian economist, Luiz Rabi.

Banking/Cards sector is a payment priority

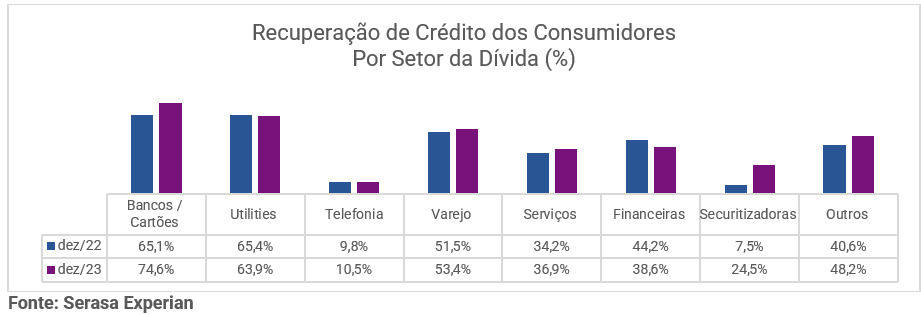

In terms of sectors, in 2023, the most debts settled by consumers were with “Banks/Cards” (74.6%). For Rabi, consumers' intention with this prioritization is to regain the trust of creditors. Next, were the “Utilities” (63.9%), which are basic bills and include water, electricity and gas bills. See the full information below:

Accounts above R$ 10 thousand were the most prioritized

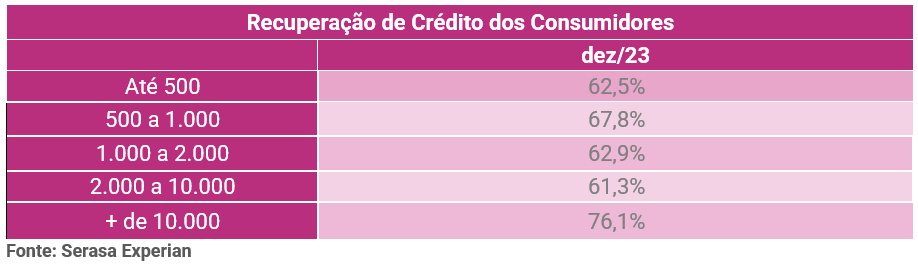

Also according to the indicator, negative accounts in 2023 with values greater than R$ 10 thousand led the regularization (76.1%). These debts, according to the Serasa Experian economist, were more prominent because they relate to financing real estate and vehicles, for example. In these cases, failure to pay can result in the loss of the good – which makes consumers prioritize commitment. Check out the view by debt value in the table below:

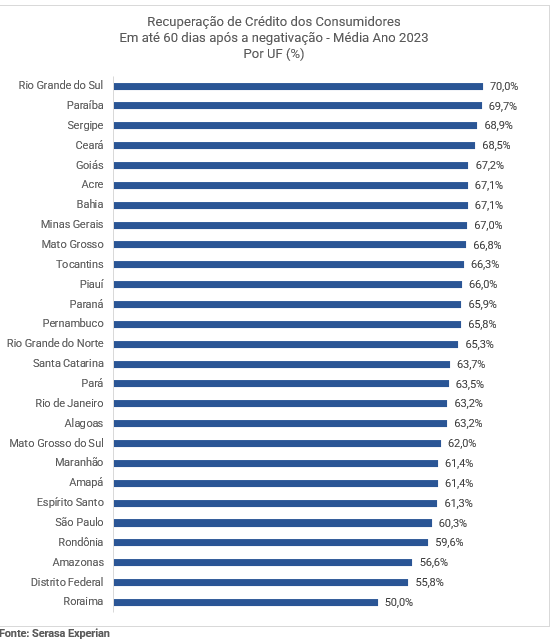

The ranking by Federative Units (UFs) revealed that, in the annual average of 2023, Rio Grande do Sul had the most significant percentage of debts paid within 60 days after the negative (70.0%), followed by Paraíba (69.7% ) and Sergipe (68.9%). Check out the survey by states:

To check more information and the historical series of the indicator, click here.

Serasa: official partner of Desenrola Brasil

Since February 2024, in addition to access through the account gov.br (using access credentials, including at the Bronze level), the official Desenrola Brasil tool can be accessed through trading platforms such as Serasa app and/or website and through the negotiation channels of the program's financial agents, see how:

- Enter the websiteSerasa (www.serasa.com.br) or download the application from stores iOS orAndroid. If you don't have a registration, just create it right away;

- click in Negotiate debts and in the tab My debts you will see all the offers available at Serasa (which may or may not be related to Desenrola Brasil);

- If there are offers from Desenrola Brasil, you will find onemessage indicating the official platform. click inSee details;

Serasa does not have any type of management over the program's official platform. Therefore, Serasa recommends that any doubts about the existence of debts and the conclusion of Desenrola negotiations be directed to the Program's official channels.

Methodology

O Serasa Experian's Credit Recovery Indicator considers the number of debts included in the default system in each specific month. The measure of up to 60 days to settle the financial commitments of this indicator was selected because it reflects the common rule used by collection solutions, but this time may vary according to each creditor. Furthermore, the historical series of the index is still short, with retroactive data since 2017, therefore, it is not possible to affirm periods of seasonality, since it would be necessary to have at least 5 years of observation to carry out this analysis.