Research is part of a series of reports by companies Incognia and idwall, which points to insights into the usage experience and effectiveness for fraud prevention of the biggest applications in Brazil

The digitization of everyday life has brought countless facilities and possibilities, but it has also opened the way for fraudulent practices. On one side are companies aiming not to hamper the processes for legitimate users; on the other, the end customer who demands a frictionless experience throughout their journey.

In this context, many of the traditional identity authentication methods are no longer as effective, even when combined in a multi-step verification flow. In a study by IDTech Incognia and regtech idwall evaluated the adoption of different identity authentication technologies across multiple platforms, as well as presenting the market trends and leading-edge solutions that are leading a more technological and practical future.

Analyzes done by idwall through the “Authentication Methods and Password Recovery in the User Journey” study show that the private sector loses around US﹩ 6 billion (R﹩ 32 billion) a year from identity fraud alone. “With the pandemic, we had a highly accelerated process of digitization in several sectors, mainly in the financial market. In this context, it is more important than ever that platforms adopt reliable solutions and technologies that combine security, UX and agility so that all the company's needs and all user expectations are met”, explains Lincoln Ando, CEO of the idwall.

According to André Ferraz, CEO and founder of Incognia, it is currently possible that banks and fintechs do the Login without passwords, in a secure way, using technology developed for authentication being done by location behavior. "We know that 90% of logins they are made in trusted locations, so the friction of an extra authentication factor can only be imposed when the location behavior is non-standard, for example. With this type of solution, the user's life apps banking services can be much easier and safer”, he says.

Banks

To prevent risks related to the access of victims' accounts by fraudsters, through cell phone theft or password, Banco Original and others fintechs use facial biometrics for the validation of large transactions. Additionally, applications that provide sensitive information on their main screens such as BTG Pactual Digital are giving the option for the customer to use biometrics in place of the password, improving their experience. In 2020, Banco Original announced extending the use of facial recognition to high value and Pix transactions. Tests were performed on the password recovery process for ten banks' applications. An average of three authentication factors were requested per bank and the average time was two minutes and 24 seconds to complete the process. Of the analyzed institutions, 50% use two authentication factors and 40% use three or more factors.

Will bank started using mobile identity by location as an additional layer of security, working in the background to detect risky situations in its digital wallet, such as scams involving social engineering. The results are encouraging: a reduction of 90% in the costs associated with account theft and of 80% in cases of account theft.

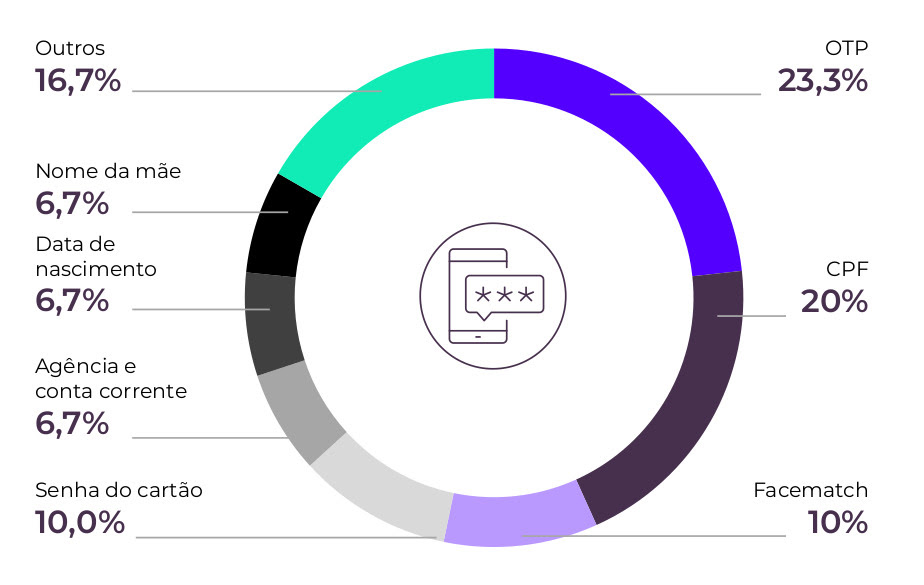

In general, there is no uniformity in user authentication options and there is great variation in the combinations used. Most institutions used the OTP method (one-time-password, or one-time password, in Portuguese), either by email or SMS and, in cases where it was not used, other information was requested, such as the CPF and card password. Only three institutions (all digital banks) use the resource face match, technology that compares the user's face with the registered one in real time. On the other hand, all scanned banks asked for the card password as a form of authentication.

About Incognia

Incognia is a Brazilian company (founded in 2014), privacy-by-design and innovator in location technology, which provides the authentication solution mobile frictionless for banks, companies fintech and e-commerces, increasing revenue mobile and reducing the cost of fraud. Currently headquartered in Palo Alto, California (USA), with teams located in the San Francisco Bay, New York and also in Brazil, it has a network of more than 100 million devices mobile .

about idwall

Founded by Lincoln Ando and Raphael Melo, in 2016, with the intention of creating trusting relationships for the Digital Age through tools such as Background Check, OCR and Face Match, idwall offers integrated and intelligent digital onboarding solutions, streamlining the process of validation of identity and helping companies to comply with compliance regulations, with automation of registration processes and preventive action against fraud. Founded by Lincoln Ando and Raphael Melo, in 2016, with the intention of creating trusting relationships for the Digital Age through tools such as Background Check, OCR and face match, idwall offers integrated and intelligent solutions for onboarding digital, streamlining the identity validation process and helping companies comply with compliance, with automation of registration processes and preventive action against fraud.