In the year 2021 until July, the electronic means of alert was the most effective format

O Serasa Experian's Credit Recovery Indicator revealed that, in the first seven months of this year, the billing format via text message via SMS was the most assertive way to recover negative debts from consumers. According to the index, 67.1% of pending issues are settled within 60 days when the digital alert model is used. Alerts via email also achieved a good recovery percentage, scoring 63.7%. The letter was the least effective, with 54.0%.

According to economist Luiz Rabi, from Serasa Experian, knowing the profile of the defaulting customer portfolio is the first step to understand which collection method needs to be used. However, "with the advancement of technology and people's interaction with the digital world, it is normal for the letter model to lose more and more space, as most consumers are connected to cell phones and the internet most of the day , making the receipt of disputes through these tools something more practical and assertive”. Rabbi also explains that “a debt can end up being written off due to forgetfulness or failure to pay via automatic debit, for example. Therefore, a simple statement of denial may be enough to boost credit recovery”.

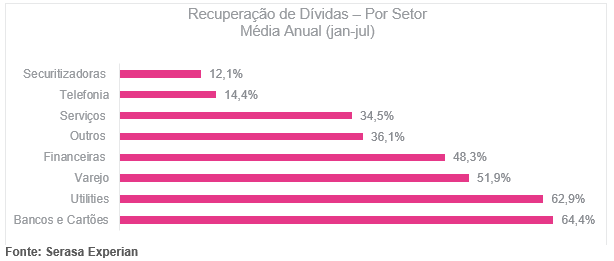

In the general analysis, taking into account the year 2021 until the month of July, the Credit Recovery Indicator indicates that 57.7% of debts are paid within 60 days after the negative. In addition, 64.4% of consumer backlogs were registered in the Banks and Cards sector, which has the highest percentage of recovery among the segments. See the full data in the chart below.

Methodology

Serasa Experian's Credit Recovery Indicator considers the number of debts included in the default system in each specific month. The measure of up to 60 days for settlement of financial commitments for this indicator was selected because it reflects the common rule used by collection solutions, but this time may vary according to each creditor. In addition, the historical series of the index is still short, with retroactive data since 2017, thus, it is not possible to state seasonality periods, since it would be necessary to have at least 05 years of observation to carry out this analysis.

To check more information and the historical series of the indicator, click here.